Leading the U.S. Internal

Revenue Services

A Conversation with Danny Werfel, Commissioner, U.S. Internal Revenue Service

By Michael J. Keegan

The IRS has a unique opportunity to envision and realize a future of tax administration that meets the evolving needs of taxpayers and the nation. The agency remains focused on improving service to taxpayers, offering them more in-person and online resources while pursuing the most effective way to ensure tax compliance. In realizing this vision, it is important that the agency has the right size workforce, with the right training and tools as well as a modern technology infrastructure, with increasingly modern web-enabled tools for taxpayers. These are needed to ensure the IRS is ready to implement the tax system of today and the future.

Danny Werfel, commissioner of the IRS, joined me on The Business of Government Hour to explore the agency’s strategic priorities, current initiatives, and long-term vision. During our conversation, Commissioner Werfel emphasizes modernization, enhanced customer service, technology-driven transformation, and the necessity of a well-trained workforce as central themes that will shape the IRS’s evolution. The following highlights the key themes and insights derived from our discussion.

Vision and Strategic Direction of the IRS

Commissioner Werfel articulates a clear vision for the IRS, emphasizing its role in providing a robust and user-centric service that meets the varied needs of taxpayers. This vision is driven by a commitment to offer a broad range of filing options, improve taxpayer experience, and ensure compliance with tax laws. “If taxpayers want to submit in paper, they should have the choice to do it,” Werfel states, underscoring the IRS’s approach to meeting taxpayers where they are, while also advocating for expanded digital filing options. He envisions a seamless menu of choices so taxpayers can decide on the filing method that works best for them—whether it’s paper, digital, or through an accountant. Werfel’s vision aims at transforming the agency to better serve taxpayers and enhance operational efficiency. Here’s a summary of the main components of his vision:

• Enhanced taxpayer service: Werfel emphasizes the importance of improving the taxpayer experience. He envisions an IRS that is more accessible and responsive to taxpayer needs. “We want to be a service organization first and foremost,” he states. This involves not only improving communication but also ensuring that taxpayers have better access to the information and resources they need.

Morley discussed the long lead times and the need for steady investments to strengthen the supply chains, particularly for critical components that extend down to third-, fourth-, and fifth-tier suppliers. This expansion is vital for supporting the Navy’s goal to ramp up production and meet current and future operational demands. “We’ve expanded the industrial base over the past few years to ensure that we’ve got the capacity and the resilience to support our needs. . . . It’s about making sure that we have enough suppliers and enough capacity to meet the demand, especially in times of crisis or conflict,” VADM Morley explains.

• Modernization and technological advancement: A significant part of his strategic vision includes modernizing the IRS’s technology infrastructure and transforming the IRS into a “truly digital agency.” Werfel highlights the need to move away from outdated legacy systems to more advanced, efficient solutions that allow for real-time processing. He notes, “We need to create a truly digital agency” to streamline operations and enhance the speed of service delivery.

• Integration of AI and data analytics: Werfel sees the potential of artificial intelligence and data analytics as transformative tools for the IRS. He discusses plans to leverage AI to improve efficiency and decision-making processes, stating, “AI can help us to fundamentally change the way we work.” By harnessing advanced technologies, the IRS can better manage data and improve compliance efforts.

• Investment in workforce development: Recognizing that people are essential to the agency’s success, Werfel stresses the need for ongoing training and professional development for IRS employees. He notes the importance of equipping staff with the skills necessary to handle complex tax issues and improve service quality, saying, “We have to invest in our people.”

• Long-term sustainability and funding: Werfel acknowledges the necessity for sustained investment in IRS modernization efforts. He points out that achieving his vision requires a long-term commitment to funding and resources, noting, “This isn’t something that’s going to happen overnight.”

During our conversation, Commissioner Werfel uses the analogy of being a train operator to illustrate the importance of focus and clarity in leadership. He states, “If you are the train operator, you have to know where the train is going.” This analogy highlights the necessity for leaders to have a clear vision and direction for their organizations. He emphasizes that understanding the destination is crucial for making informed decisions and effectively guiding the agency forward, particularly in the context of the IRS’s modernization efforts and service improvements.

Overall, Werfel’s strategic vision for the IRS is comprehensive, focusing on enhancing taxpayer services, modernizing technology, leveraging AI, investing in the workforce, and securing long-term funding to create a more effective and responsive agency.

Impact of the Inflation Reduction Act

Prior to delving into specific initiatives, we discuss the Inflation Reduction Act (IRA) and its impact on the IRS. Commission Werfel explains that the IRA provides the agency with significant, multiyear funding that will enable the agency to make substantial improvements and investments in several key areas. Werfel emphasizes that the IRA is not just about funding day-to-day operations but is designed to support transformative changes that will modernize the IRS and enhance its capacity to serve taxpayers effectively. “This act provides the agency with sustained funding over multiple years, which allows us to plan and execute modernization projects in a more comprehensive and strategic manner,” says Werfel.

He notes that the IRA funding is being strategically allocated to support long-term investments in technology, taxpayer services, and enforcement capabilities. This approach will allow the agency to make substantial progress in areas that have traditionally faced resource constraints. He points out that one of the critical aspects of the IRA funding is its role in modernizing the IRS’s aging technology infrastructure. With this funding, the IRS can accelerate the replacement of legacy systems and implement new technologies that will improve the efficiency of operations and provide better service to taxpayers. Werfel highlights the opportunity the IRA presents for a more stable and secure technology environment: “For the first time in many years, we have the resources to make the needed technology upgrades that will allow us to operate more effectively and securely,” he says.

IRA funds are also being used to strengthen the agency’s enforcement efforts, providing resources that will allow the agency to close the tax gap and ensure that all taxpayers meet their obligations under the law. Werfel points out that this focus on enforcement is essential for maintaining the integrity of the tax system and ensuring that the IRS can effectively address complex tax issues. According to Werfel, the ultimate goal is to create a more responsive and effective agency that can better serve the American public. He states, “This is about creating a system that is going to have more integrity, that is going to be more efficient, and that will help us fulfill our mission more effectively.”

Modernizing the IRS’s Technology Infrastructure

The modernization of the IRS’s technology infrastructure is a recurring theme in our conversation. He acknowledges that while hardware and software updates are relatively straightforward, the real challenge lies in upgrading the foundational technology—the “millions and millions of lines of code” that need to be reworked. He compares the IRS’s situation to banking infrastructure, where transactions are updated in real-time, noting, “If you were to leave here and stop at an ATM machine on your way and take out $100, it would already present that you took out $100.” This is not yet the case at the IRS, where transactions like tax payments take time to reflect on online accounts due to legacy systems.

The modernization effort, however, is not just about updating systems, but also about achieving better data exchanges, standardization, and real-time processing capabilities. Werfel believes that the IRS must invest in modern infrastructure to “ensure that all taxpayers can interact digitally, if they choose,” and have a comparable customer experience to other financial services. He emphasizes that this transformation cannot be rushed, given the complexity and criticality of the systems involved. Even a minor error in this code could disrupt the entire system, halting critical processes like payment submissions or refunds. “I would rather be accused of it taking a long time than have the lights going out,” Werfel says.

“Artificial intelligence is a big part of our strategy going forward.”

Danny Werfel, IRS Commissioner

Leveraging Technology and Innovation

In addition to modernizing existing systems, Werfel highlights the potential of new technologies like artificial intelligence (AI) to help accelerate modernization and improve operations. “Artificial intelligence,” he explains, “is a big part of our strategy going forward.” He mentions that AI tools are being developed and integrated into various functions within the agency, which aims to increase efficiency and accuracy in IRS operations. He explains that AI is being used to improve decision-making processes, streamline operations, and enhance customer service.

Werfel highlights the potential of AI to analyze large volumes of data quickly and accurately, which can help the IRS identify trends, detect fraud, and provide better insights into taxpayer needs. He also underscores that AI has the capacity to assist with translating legacy coding into modern programming languages, speeding up a process that would otherwise take years. This use of AI is not only cost-effective but also a strategic way to overcome the technical debt the IRS has accumulated over decades.

Expanding Omnichannel Customer Experience and Service Delivery

Customer service is at the heart of Werfel’s vision for the IRS. He envisions a taxpayer experience that is as seamless and user-friendly as possible, akin to how people interact with their banks or other service providers. A significant aspect of the modernization strategy is improving the taxpayer experience through a more integrated and omnichannel service model. The IRS aims to offer multiple channels through which taxpayers can interact with the agency—whether through phone, in-person visits, online portals, or mobile applications. This will require the development of a unified digital interface that allows taxpayers to access their accounts, file returns, and communicate with IRS representatives seamlessly.

Werfel mentions plans to improve walk-in services and reduce wait times, particularly in high-demand areas. The IRS is also investing in better call center technology and expanding online self-service options, enabling taxpayers to resolve issues without needing to speak to an agent. By enhancing service delivery through multiple channels, the IRS aims to provide a more responsive and user-friendly experience for all taxpayers.

The Direct File Pilot is central to this initiative, aiming to provide a direct, electronic, and free filing option with the IRS. This program complements existing methods like paper filing, use of professional accountants, or commercial tax software providers. This pilot, initially rolled out in roughly a dozen states, attracted more than 140,000 users who provided overwhelmingly positive feedback. Consequently, the IRS plans to expand this service nationwide, working closely with states to integrate their tax systems seamlessly. Werfel likens the expansion of Direct File to adding an item on a restaurant menu and then inviting reviews to ensure quality and satisfaction. The IRS now aims to make this a permanent offering, reflecting its responsiveness to taxpayer preferences.

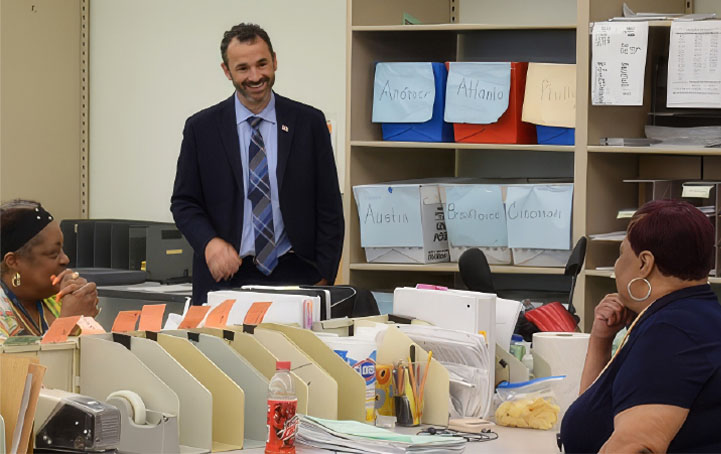

Strengthening Human Capital and Workforce Development

The IRS’s transformation hinges not only on technology but also on its workforce. Werfel stresses the need for skilled personnel to support various IRS functions, including direct taxpayer services, compliance, and technological operations.

Werfel addresses misconceptions about the IRS’s staffing strategy, noting that calls to “supersize” the agency with armed agents are misleading. Instead, the agency’s real need is for more staff to handle the increased demand for taxpayer assistance. The need for a skilled workforce capable of implementing and maintaining these ambitious initiatives is another central theme in Werfel’s narrative. “Our workforce is absolutely essential because we interact,” Werfel states, likening the IRS to other government agencies that have significant human interactions, such as the TSA or the Postal Service.

Werfel also emphasizes the importance of training and development, ensuring that new hires are not only technically proficient but also equipped with soft skills like empathy and customer service. He highlights the agency’s efforts to bring in individuals who can understand the taxpayer’s perspective and help them navigate complex tax situations. This holistic approach to workforce development is critical to building a responsive and resilient IRS that can meet the challenges of the future.

Enhancing Data Security and Cybersecurity Measures

As the IRS modernizes its systems and processes, data security, and cybersecurity will remain top priorities, especially given the sensitive nature of the information it handles. Werfel highlights the need for robust cybersecurity measures to safeguard sensitive information in an increasingly digital environment. The next steps involve implementing advanced cybersecurity protocols, continuously monitoring for threats, and ensuring that all new systems adhere to the applicable federal guidelines for data security.

He underscores the need to stay ahead of potential threats by continuously investing in cybersecurity capabilities. This entails not only hiring experts in the field but also deploying cutting-edge technologies to protect taxpayer data and ensure the resilience of IRS systems against cyberattacks. This focus on security has enabled the IRS to significantly improve its security posture and sharply reduce risks for taxpayers and the tax system.

Conclusion

Werfel’s overarching vision is to make the IRS a digitally-enabled agency. His candid discussion of the challenges and opportunities ahead reflects a pragmatic yet optimistic outlook. This vision will take time to realize, given the complexities of modernizing legacy systems and the scale of the IRS’s operations. However, the commitment to this transformation is evident in the agency’s strategic investments in technology and people. “You need funding in order to do all of this,” he asserts. The recent funding boost for the IRS has enabled the agency to embark on its modernization journey, but Werfel remains cautious about balancing speed and security, acknowledging that the complexity of the task requires a methodical approach.

Resources

To learn more about the Air Force Research Laboratory, go to navy.mil.

To hear the interviews from The Business of Government Hour, go to businessofgovernment.org/interviews.

To download, listen, and subscribe to the show, go to Apple Podcast, Spotify or Audible

To view excerpts of the show, go to youtube.com/businessofgovernment.