A Prepared Federal Government:

Preventing Fraud and Improper Payments in Emergency Funding

By Steve Goodrich and Bob Westbrooks

This article is adapted from A Prepared Federal Government: Preventing Fraud and Improper Payments in Emergency Funding by Steve Goodrich and Bob Westbrooks (Washington, D.C., IBM Center for The Business of Government, 2024).

When the government distributes supplemental funding to address various national emergencies such as the global pandemic, time is of the essence. Putting money quickly in the hands of Americans in need benefits vulnerable segments of the American population and stabilizes the nation in a time of crisis. At the same time, transparency and accountability mechanisms are essential to safeguard these taxpayer dollars and maintain public trust.

Rapid program delivery and program integrity are not mutually exclusive, but it can be difficult to establish the appropriate controls and checks and balances and produce the desired outcome in a fast-moving crisis. With a combination of new programs, additional funding, and broader program eligibility, the risk of waste, fraud, and improper payments increases significantly.

This report began with a roundtable discussion of experts in government fraud and improper payments in December 2023. Leaders and experts from the budget, financial management, data and oversight communities came together with those with experience in implementing efficient, effective, and lawful tracking and safeguarding of taxpayer dollars during emergency situations. These roundtable discussions generated insights on how the government can ensure integrity while meeting policy and programmatic goals in increasingly frequent emergency situations.

The report documents the challenges that governments experience with fraud and improper payments, especially during a national emergency. It also profiles the many collaborative initiatives currently underway to create lasting solutions to reduce fraud and improper payments. It includes 27 recommendations that Congress and federal agencies can use to ensure the integrity, efficacy, and protection of funds distributed in increasingly frequent emergency situations.

Steve Goodrich

President and CEO

The Center for Organizational Excellence, Inc. Steve has more than 40 years of leading organizations and advising top government and private sector leaders in organizational effectiveness strategies to improve performance and effectiveness. He currently serves as Chairman of the Board of the federal Shared Services Coalition and was the Co-Founder and Vice Chair of the Government Transformation Initiative.

Introduction

When an emergency has subsided, the federal government typically goes back to business as usual, does little to identify lessons learned, and rarely acts on them to be prepared for the next national crisis. But in the case of the pandemic, agencies are proactively addressing many lessons learned. The federal government—through the combined and collaborative efforts of the Department of the Treasury (Treasury), Office of Management and Budget (OMB), Pandemic Response Accountability Committee (PRAC) of the Council of the Inspector’s General on Integrity and Efficiency (CIGIE), General Accountability Office (GAO), Congress, and agency program offices—are actively addressing some shortfalls with solution to fraud and improper payments. The report that this article is excerpted from intends to assist in the process of capturing lessons learned and providing a whole-of-government perspective.

• Identify the specific management and oversight challenges associated with distributing government funds under emergency conditions prior to and after distribution.

• Make recommendations to ensure effective safeguards and oversight methods (policy, practices, tools, resources, systems, and authorities) to be ready for the next emergency funding need.

Background on Emergency Funding

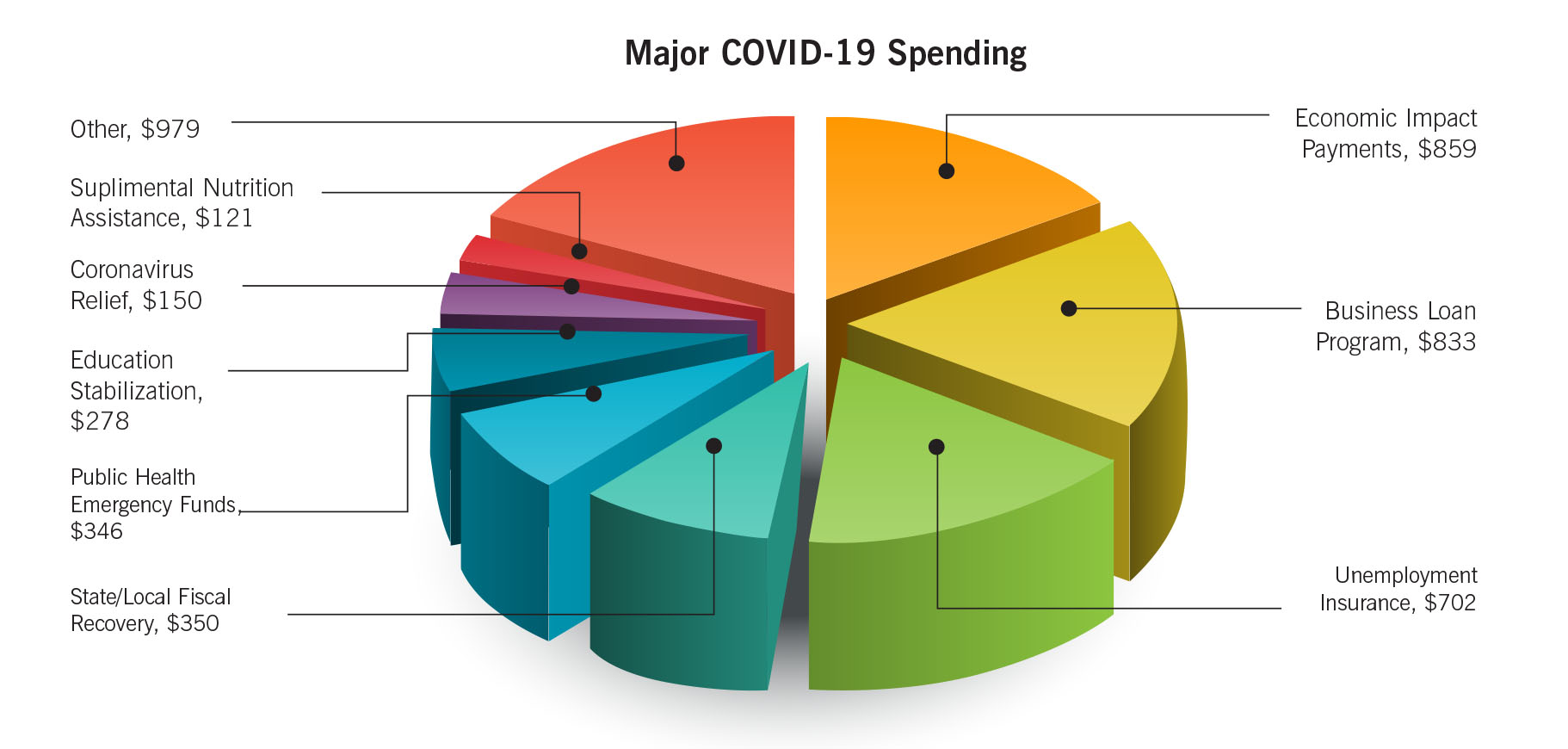

For each emergency, the federal government legislates programs and releases funding through a defined disaster declaration process. Agencies are typically prepared to manage and fund many of them. Yet government programs are not always prepared for emergencies of significant magnitude such as hurricanes Katrina or Sandy, or the most recent emergency, the COVID-19 pandemic. To address this pandemic, Congress responded with programs and emergency funding to support businesses, healthcare, COVID testing, the supply chain, healthcare workers, mental health, unemployment insurance, rental assistance, and more. Never has so much money been injected into the U.S. economy in such a short period of time. It is estimated that with most of the $5 trillion appropriated, over $600 billion was taken fraudulently and/or subject to improper payments.

The increased flow of funds in response to the COVID-19 pandemic exposed existing vulnerabilities in federal and state government payment systems and processes that resulted in increased improper payments—including fraud—in federal programs.

About $1.4 billion of the $600 billion stolen has been returned to the federal government, and over 3,500 people have been criminally charged. As Small Business Administration (SBA) Inspectors General Mike Ware predicted in a 2021 interview, the amount of fraud from COVID relief programs was “larger than any government program that came before it.

Two key definitions help to frame an understanding of the nature and extent of this challenge.

• Improper payments are payments that should not have been made. This may be due to wrong amounts (either over or under), payments to the wrong person or corporation, or payments that did not follow statutory requirements. They may or may not include some level of fraud.

• Fraud involves paying an entity that is not entitled to the payment based on misrepresentation.

Both require effective prepayment controls and post-payment oversight and corrective action protocols to be put into place when programs are established and executed. The Government Accountability Office identifies root causes of improper payments and fraud to include:

Improper Payment Root Causes

• Failure to access data/information needed

• Data/information needed does not exist

• Lack of documentation from recipients to determine eligibility

Fraud Root Causes

• Opportunity, incentive, and rationalization on the part of the perpetrator

• Weak internal controls

• Undetected misrepresentations, falsifications, social engineering, data breaches, cybercrime, or coercion

• Lack of independent verification of applicant’s information

Bob Westbrooks

Fellow, National Academy of

Public Administration

Bob is an attorney, certified public accountant, certified internal auditor, former federal investigator, and fraud and corruption risk expert. He served as an Inspector General prior to being designated as Executive Director of the Pandemic Response Accountability Committee at the beginning of the national pandemic emergency.

This report seeks to help ensure that there is not a zero-sum trade-off between getting money out quickly, serving the nation, protecting program integrity, and minimizing fraud. The government is expected to be an effective custodian of taxpayer funds. Putting the policy, tools, and programmatic infrastructure into place now without overburdening agencies and the budget is essential. Taxpayer funds must be managed effectively, efficiently, and equitably to address an emergency, ensure proper use of public funds, and build the trust of the public.

Recommendations

The goal of these recommendations is for the government to be ready and more effective when the next emergency strikes, while attempting to not add significant expenditure of funds during nonemergency times. Here is a sampling of the proposed recommendations outlined in the report directed at Congress, Office of Management and Budget, Treasury, Inspectors General, agency programs, and for states. While the recommendations highlighted above focus on emergency funding initiatives, many can also be applied to existing agency funding programs.